Eligibility Part 1: Location, Balance Sheet Equity, and Term

October 10, 2020

#USDA News | #Eligibility | #OneRD Changes

Location Eligibility:

5001.102(b) Project eligibility - general. Location. A project must be located in a State and meet the rural or rural area requirements of the applicable section in 5001.103 through 5001.108.

Eligibility location is still based on the eligibility map which designates what is rural and what is not. If a project is located in an ineligible area but that area could be considered "Rural in Nature" then the lending institution can petition the national office to award a waiver to the regulations to make that individual project eligible. In my experience, this is a rare occurrence however you should still reach out to your State Program Director and consult with them. There are areas in the United States that can be mitigated.

Additionally, the Community Facilities program will now allow for projects in a city or town with up to 50,000 in population. This is an increase from the 25,000 level that was historically used.

Balance Sheet Equity:

This is probably one of the largest changes between the RD5001(New Regulation) and RD4279(Old Regulation). The old regulation focused on an abstract balance sheet metric called Tangible Balance Sheet Equity. Tangible balance sheet equity was found by removing intangible assets from total assets and diving by total equity. While the math may be simple the classification of assets as tangible and intangible were not. The USDA tried to make this easier by providing a multi-page appendix of balance sheet entry classifications to help lenders property classify assets. This process was very cumbersome and lead to each State Office interpreting the rules differently.

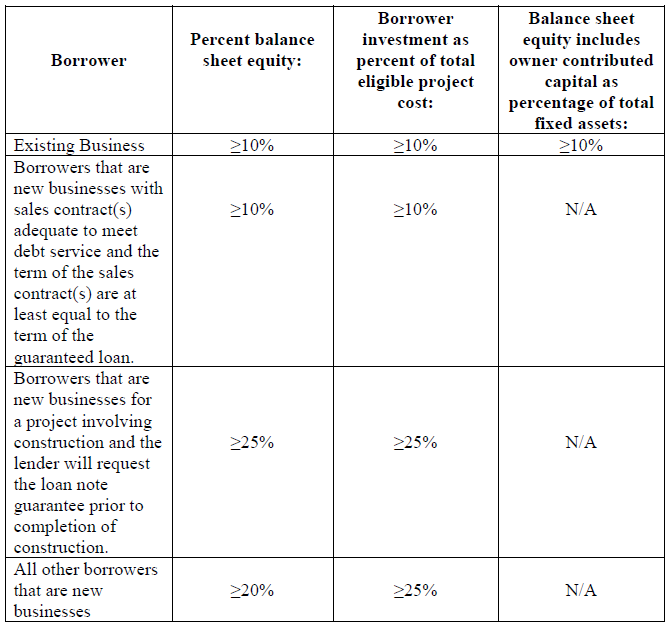

The new regulation cuts out Tangible Balance Sheet Equity and replaces it with Balance Sheet Equity. The USDA even provides a matrix, shown below, and makes determining Balance Sheet Equity much easier based on the project and even gives options to injected based on a percentage of project, should Balance Sheet Equity be negative.

Negative equity on the balance sheet was a non-starter for most businesses applying under the old regulations because that businesses needed to have 10% or 20% Tangible Balance Sheet Equity to be eligible. Under the new regulations, a business can have negative equity as long as they inject the proper percentage of the project. This is a wonderful change that will help a lot of businesses, especially once that use accelerated depreciation methods in the first few years of their operations.

Loan Terms:

5001.402 Term length, loan schedule, and repayment.(a) Term length. The lender, with Agency concurrence, will establish and justify the guaranteed loan term based on the use of guaranteed loan funds, the useful economic life of the assets being financed and those used as collateral, and the borrower's repayment ability. The maximum term allowable for final guaranteed loan maturity is limited to the justified useful life of the project or assets used as collateral but may not exceed 40 years or limitations in the applicable State statute, whichever is less.

The new regulations regarding maximum loan term take a major step back (or forward?) and allow banks to set the terms based on the justifiable useful life of the assets being financed. (This seems too good to be true right?)

The first question you should have is "How do you determine the useful life of all of the financed assets in one loan package?" In the old regulations you would follow the table below to make this determination and blend the terms together based on weighted average of loan funds. In the new regulations it is not explicitly stated how the max term is calculated for multi-asset class financing.

| RD4279 Max Terms | RD5001 Max Terms |

| Real Estate - 30 years | 40 years max --or-- |

| FF&E and Machinery - 15 years or UL | justifable useful life |

| Cash/Closing/Other - 7 years |

So how do we determine and justify our proposed loan term? Do we do what the SBA does and say as long as there is more than 50% CRE being financed that it is a 25 year 30 year (or 40 year) loan term? Or should you just modify the old blended rate calculator and switch the 30 year CRE to 40 years? Do you set the term based on borrower DSC?

As an analyst the best way for me to do it would be to reset the blended rate worksheet and use that as a starting point. Loans with more FF&E and Machinery will need to rely heavier on the useful life in any situation. As a lender, I would prefer the SBA approach to deciding max term. Since USDA loans need to be fully collateralized, most loan funds will be applied to CRE anyway so you can ensure the loan would receive the max of 30 years.

The most difficult task of the new regulations is supporting the term of the proposed loan to the USDA as there is no criteria to judge a proper term except for "justifiable useful life" which can be interpreted in many ways. Most banks will need to include additional analysis in their Lenders Analysis/Credit Memo to address the maximum term and how the term set on this loan aligns with the project use of proceeds and bank policy.

You can find a loan term worksheet by following this link or going to our documents page

About Me

I have originated, underwritten, and managed USDA B&I and CF loans for 8 years. I obtained a MBA from Valdosta State University in 2012 and have more than 11 years of banking experience. In my free time I like to work on my farm, golf, and spend time with my wife and two kids (1 & 3).

Follow Me:

Linked-In